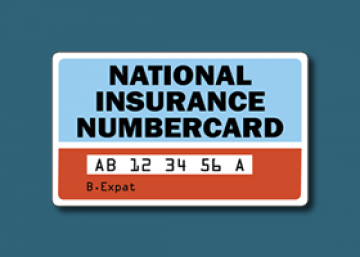

n essence if you live and work in the UK and have sufficient income you will automatically pay National Insurance contributions. However, if you have moved abroad, your National Insurance contributions will cease. Why are National Insurance contributions important? Ultimately your National Insurance contributions pay towards things. Any benefits you may receive when you live […]